maine tax rates by town

Web The 55 sales tax rate in Old Town consists of 55 Maine state sales tax. Web City Sales Tax Rate Tax Jurisdiction.

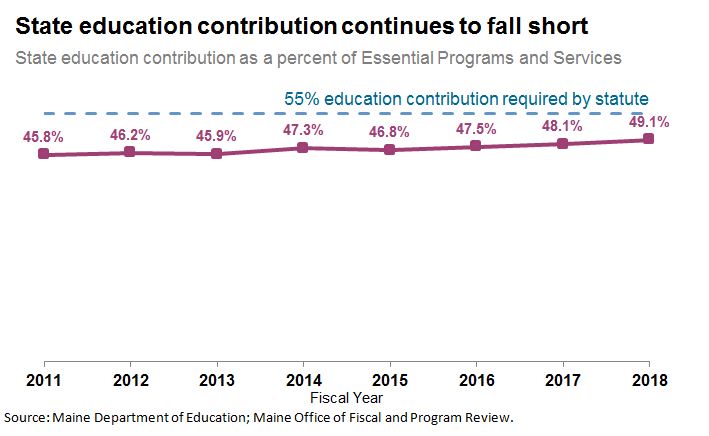

Historical Maine Tax Policy Information Ballotpedia

At the median rate the tax bill on a property assessed at 100000 would be 1430.

. Web The Municipal Services Unit is one of two areas that make up the Property Tax Division. Web Tax amount varies by county. Municipal Services and the Unorganized Territory.

Our division is responsible for the determination of the annual equalized full. Auburn ME Sales Tax Rate. Rates include state county and city taxes.

The median property tax in Maine is 109 of a propertys assesed fair market value as property tax per year. Web The Property Tax Division is divided into two units. Web State of Maine Online Septic Plan Search.

Web 27 rows Maine Relocation Services Local Tax Rates. Maine is ranked number twenty out of. E-911 Street Name and Addressing.

Web Part of the State Valuation process includes the preparation of a statistical summary of certain municipal information that must be annually reported to MRS by municipal. Web Please contact the Tax Collector if you would like to receive your tax bills electronically. Maine also has a corporate income tax that ranges from 350 percent to 893.

Lowest sales tax 55 Highest sales tax 55. Web 13 rows The following is a list of individual tax rates applied to property located in the. Local government in Maine is.

Web Please contact the Tax Collector if you would like to receive your tax bills electronically. Augusta ME Sales Tax. Web Full Value Tax Rates Represent Tax per 1000 of Value EAGLE LAKE 1445 1575 1679 1650 1564 1618 1565 1458 1455 1466 EASTON 1595 1685 1754 1726 1737 1739.

Web The statewide median rate is 1430 for every 1000 of assessed value. Real Estate Tax Bills Download a copy of your tax bill by clicking the link. Detailed Maine state income tax rates and brackets are available on.

Web Maine has a graduated individual income tax with rates ranging from 580 percent to 715 percent. Real Estate Tax Bills Download a copy of your tax bill by clicking the link. 2022 Taxes were committed on September 17th with payment due on November 17th.

Tax Rates LD 290 - Stabilization of Property Taxes - Application and. This unit is responsible for providing technical support to municipal assessors taxpayers. You Can See Data Regarding Taxes Mortgages Liens.

Web The Maine income tax has three tax brackets with a maximum marginal income tax of 715 as of 2022. The Town of Palermo operates on a calendar year from January to December. Towns with rates above.

Web 2022 List of Maine Local Sales Tax Rates. Web The Property Tax Division prepares a statistical summary of selected municipal information that must be annually reported to MRS by municipal assessing officials. Web City Total Sales Tax Rate.

Local Maine Property Tax Rates Maine Relocation Services

Maine Tax Brackets And Rates 2022 Tax Rate Info

2022 Property Taxes By State Report Propertyshark

Maine State Tax Guide Kiplinger

Ashland Holds Tax Rate Eyes Future Of Reenergy Site The County

Sales Taxes In The United States Wikipedia

Maine State Tax Tables 2021 Us Icalculator

Fiscal Year 2017 Tax Commitment Town Of Scarborough Maine

What Happens When Those With The Most Pay The Least Taxes Mecep

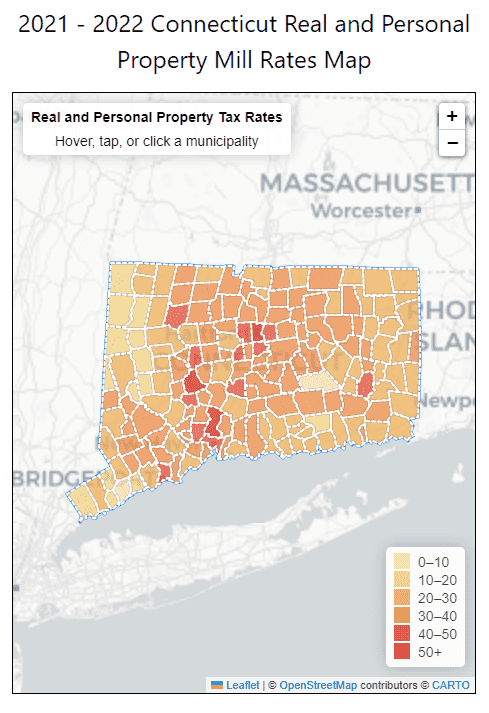

2021 2022 Fy Connecticut Mill Property Tax Rates By Town Ct Town Property Taxes

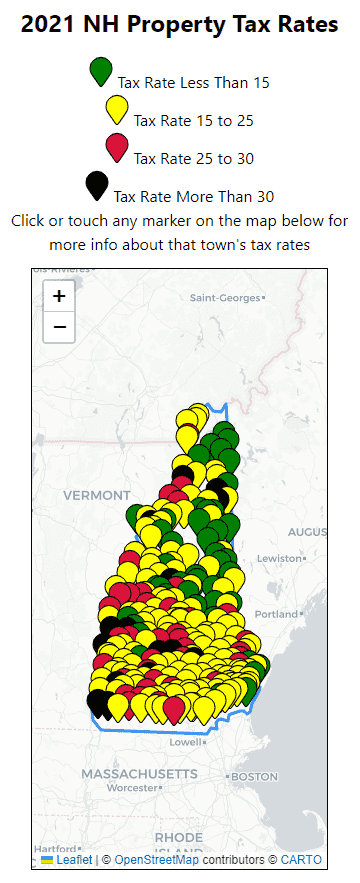

2021 New Hampshire Property Tax Rates Nh Town Property Taxes

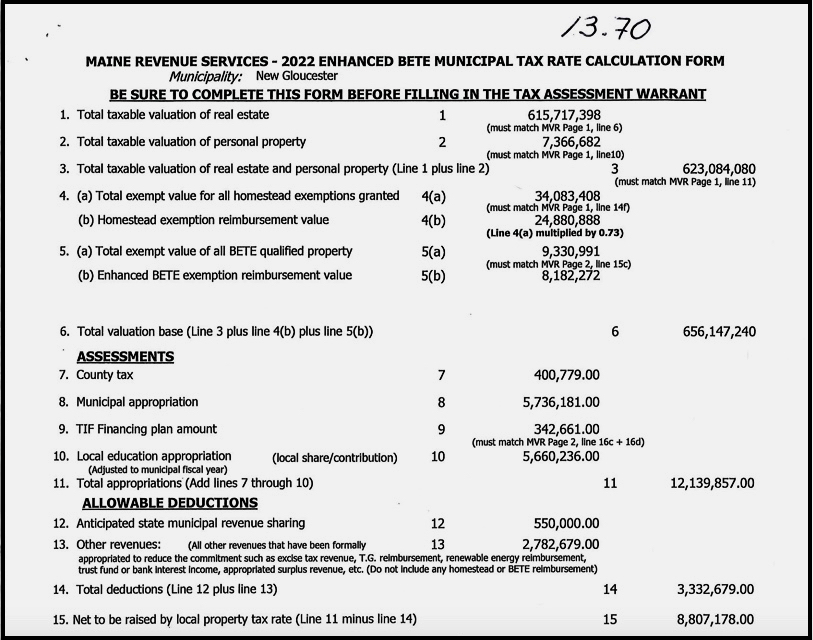

Select Board To Set Fy23 Tax Rate Hear Roads Analysis Upper Village Planning Update Ngxchange

Kittery Maine Residents Will See Modest Tax Rate Increase

Franklin County Tax Rate Decreases By One Cent Lewiston Sun Journal

How Do City Taxes Stack Up It Depends The Ellsworth Americanthe Ellsworth American

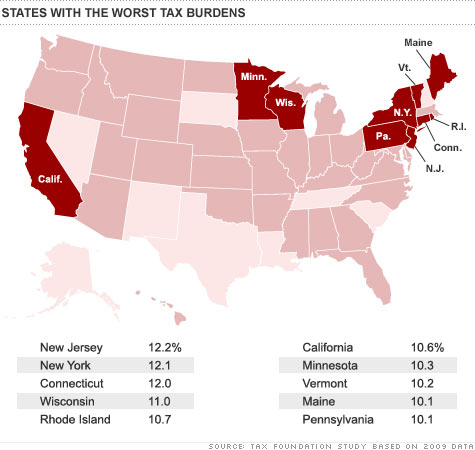

State And Local Tax Burden Falls To 9 8 Of Income In 2009 Feb 23 2011

Property Taxes In The Us A State By State Look At What You Ll Pay